Most financial decisions are planned using forecasts, budgets and simple risk modelling. These methods work fine when markets move slowly and things stay normal. The problem starts when reality hits harder than expected. Interest rates rise suddenly, cash becomes tight and markets panic. Traditional finance forecasting stress test methods are not built for these situations because they only test small changes.

That is why stress testing came into use. Stress testing financial model 2026 helps firms see what happens when conditions turn bad, not comfortable.

This article breaks down stress testing and explains why it matters in real risk management.

What Is Stress Testing in Risk Management?

Stress testing is a method used to check how a business, bank, or investment portfolio would perform under extreme but possible conditions. These conditions can include deep recessions, sudden interest rate hikes, market crashes, or funding freezes.

Instead of asking what is likely to happen, stress testing asks what could happen if conditions turn ugly. A stress testing financial model 2026 applies strong shocks to financial data to see how much damage the organization can absorb.

This approach goes beyond normal finance forecasting stress test exercises. It pushes risk modelling into uncomfortable territory. The goal is not to predict the future but to understand vulnerability.

Once this idea is clear, the next question becomes why firms invest so much time and money into stress testing.

Why Stress Testing Matters So Much?

The core purpose of stress testing is to reveal weak points before they turn into disasters. Many risks remain hidden during stable times. Stress testing pulls those risks into the light.

A strong stress testing financial model 2026 helps firms measure capital strength, liquidity resilience and earnings stability under pressure. It also supports smarter decisions on risk appetite and balance sheet planning.

For banks and financial institutions, stress testing supports regulatory compliance. For companies and investors, it strengthens internal risk modelling and long-term planning. In all cases, stress testing transforms finance forecasting stress test outputs into practical decision tools. Different risks require different stress testing approaches. That is why multiple types of stress testing exist.

Types of Stress Testing Used in Practice

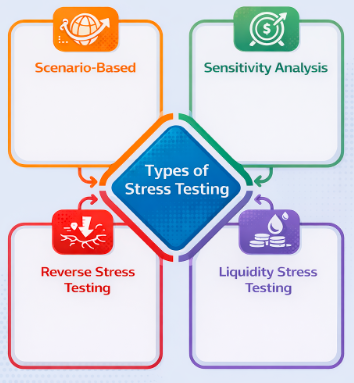

Stress testing is not a single method. It is a family of techniques designed to test different risk angles.

Figure 1: Types of stress testing used in finance shown through scenario based, sensitivity, reverse, and liquidity approaches within a stress testing financial model 2026 framework.

- Scenario-based stress testing looks at broad economic or market events. These can include recessions, inflation spikes, currency crashes, or credit market shutdowns. A stress testing financial model 2026 often combines multiple shocks at the same time to reflect real crisis behavior.

- Sensitivity analysis changes one variable at a time. For example, it may test what happens if interest rates rise sharply while everything else stays constant. This form of finance forecasting stress test is useful for understanding individual risk drivers.

- Reverse stress testing starts from failure. Instead of asking what could go wrong, it asks what would actually cause collapse. Risk modelling teams then work backward to see how realistic those conditions are.

- Liquidity stress testing focuses on cash flows. It tests how long a firm can survive when funding becomes difficult. In modern markets, liquidity risk has become just as dangerous as credit risk.

Each type serves a purpose. Together, they form the backbone of stress testing financial model 2026 frameworks.

How Stress Testing Works Step by Step?

Stress testing follows a clear and structured process even though the scenarios themselves may feel extreme.

Figure 2: Step-by-step process of identifying risks, designing scenarios, applying shocks, analyzing results, and taking action in a stress testing financial model 2026.

- First, firms identify key risk exposures. These include interest rates, credit quality, market prices, funding sources and operational risks. Strong risk modelling starts here.

- Next, stress scenarios are designed. These scenarios must be severe but still realistic. In stress testing financial model 2026, scenarios often reflect modern risks like rapid rate cycles or global liquidity tightening.

- The third step applies shocks to financial models. Balance sheets, income statements and cash flows are recalculated under stress. This is where finance forecasting stress test techniques come into play.

- After that, the results are analyzed. Firms measure losses, capital erosion, liquidity gaps and survival timelines.

- Finally, management takes action. This is the most important step. Stress testing is useless if results sit in reports. The insights must influence decisions, funding plans and risk limits.

Understanding this process also helps clarify how stress testing differs from similar tools.

Stress Testing vs Scenario Analysis vs Sensitivity Analysis

These terms are often used interchangeably, but they are not the same.

| Basis | Stress Testing | Scenario Analysis | Sensitivity Analysis |

| Main purpose | Check survival under extreme conditions | Explore possible future situations | Measure the impact of one small change |

| Focus | Worst-case but realistic outcomes | Structured stories of the future | One risk factor at a time |

| Severity level | Very high | Medium to high | Low to medium |

| Number of variables | Multiple risks together | Multiple risks together | Single variable |

| Typical questions | What could seriously damage us | What might happen in this situation | What if this one factor changes |

| Use in practice | Crisis preparedness and capital planning | Strategic planning and decision making | Day-to-day risk checks |

| Role in risk management | Core tool for extreme risk | Support tool for planning | Basic tool for quick analysis |

| Relation to stress testing financial model 2026 | Central framework | Supporting method | Building block |

In practice, a strong stress testing financial model 2026 uses all three. Risk modelling improves when these tools work together instead of competing. Regulators also care deeply about stress testing, which adds another layer of importance.

Stress Testing and Regulatory Expectations

After past financial crises, regulators realized that normal models were not enough. Stress testing became a core supervisory tool.

Regulators use stress testing to check whether institutions can absorb large losses without collapsing. Capital adequacy, liquidity strength and business continuity all matter.

Many institutions now run internal stress testing financial model 2026 exercises that go beyond minimum regulatory requirements. These internal tests improve finance forecasting stress test accuracy and reduce surprise during real shocks.

However, even the best stress testing frameworks have limitations.

What Real World Experience Teaches Us?

Looking back at past financial crises, one thing becomes clear. Stress testing often failed because people trusted their models too much. Assumptions were kept optimistic and risks were underestimated. When conditions changed quickly, those models did not hold up.

Institutions that came through crises in better shape usually behaved differently. They tested tougher situations, questioned their own numbers and did not treat stress testing as a formality. Instead, they used it while making real decisions about capital, liquidity and risk limits. Reviews after events like the 2008 Global Financial Crisis (GFC) and the European debt crisis showed that this approach helped firms react earlier and reduce damage. Institutions that treated stress testing only as a compliance task were generally slower to respond.

A practical stress testing financial model 2026 accepts that not everything can be predicted. It focuses less on perfect forecasts and more on whether the business can cope when things go wrong. This naturally brings attention to the limits of stress testing.

A realistic stress testing financial model 2026 accepts uncertainty. It acknowledges that risk modelling cannot predict every event. It focuses on resilience rather than precision. This honesty leads naturally into the limits of stress testing.

The Limits of Stress Testing

Stress testing depends on assumptions. If assumptions are wrong, results can be misleading. Models also struggle with events that have no historical reference.

Behavioral reactions are another challenge. During crises, people panic. Markets overreact. These factors are difficult to capture in finance forecasting stress test models.

This does not make stress testing useless. It simply means it should guide decisions, not replace judgment. Knowing the limits allows firms to use stress testing more wisely.

Best Practices for Better Stress Testing

Effective stress testing is not about complexity. It is about discipline.

- Firms should update scenarios regularly and reflect current market conditions. They should combine numbers with expert judgment. Results should influence real decisions.

- A strong stress testing financial model 2026 connects risk modelling directly to strategy. It prepares firms mentally and financially for disruption.

When done right, finance forecasting stress test results do more than protect balance sheets. They build confidence.

People Also Ask About Stress Testing in Risk Management

- What are the three types of stress tests?

The main types are scenario based stress testing, sensitivity analysis and reverse stress testing. Each checks risk from a different angle. - How is a stress test done?

A stress test applies extreme but realistic shocks to financial data to see how capital, liquidity and profits hold up. - What’s a good score on a stress test?

There is no score. A good result means the firm survives stress without running out of capital or cash. - Why is stress testing important today?

Because markets change fast. Stress testing shows weak spots early and helps firms prepare before real damage happens.

Verdict

Stress testing exists because finance does not always behave nicely. Forecasts, budgets and basic risk modelling work in calm times, but they break under pressure. Stress testing fills that gap by forcing firms to face uncomfortable scenarios before they become real.

A strong stress testing financial model 2026 does not predict the future. It prepares businesses for it. When used seriously, stress testing turns uncertainty into awareness, panic into planning and risk into something that can actually be managed.So for students looking to understand risk beyond textbooks, The Wallstreet School’s FRM Coaching Classes focus on building practical stress testing and real-world risk thinking, not just exam formulas.